What is Bookmaker’s Over-round?

Another way of phrasing the question posed in this article’s title is to ask: How do bookmakers make money? Once you understand this, you will see why betting exchanges offer better value than traditional bookmakers.

For bookmakers to remain in business they need to be profitable in the long term. The key way they achieve this is by including a profit margin on the prices they offer on an event. This profit margin is known as the “Over-round” or the “Vig” and refers to the guaranteed profit a bookmaker will make provided that the prices offered attract bets on all outcomes in the desired proportions.

Over-round explained

To reflect the combined true probabilities of various outcomes in an event, the odds for each outcome when converted to a percentage should total 100%. For example, if the event in question is the toss of a coin, there is an equal chance of either a head or a tail being tossed. Therefore, the percentage chance of either outcome occurring is 50%, totalling 100% for the two combined. To reflect the true probabilities in this event, the odds offered by the bookies when laying either heads or tails should be 2.0 or “even money”. When these odds are converted to a percentage and added together the total is 100 (100/2.0 + 100/2.0) = (50 + 50). This is known as a "round book” or a “100% book”.

By adjusting these odds so that the total exceeds 100%, it is possible to build a profit margin into the prices offered, which, assuming an equal number of backers for either outcome, guarantees a profit for the layer no matter what happens. The amount by which the prices exceed 100% is called the Over-round. For example, if heads or tails was laid at 1.9 rather than 2.0, the over-round would be 5% (100/1.9 + 100/1.9) = 105. Assuming both heads and tails are each backed with a stake of £10, £1 profit is guaranteed for the layer (£20 taken with a total pay-out of £19).

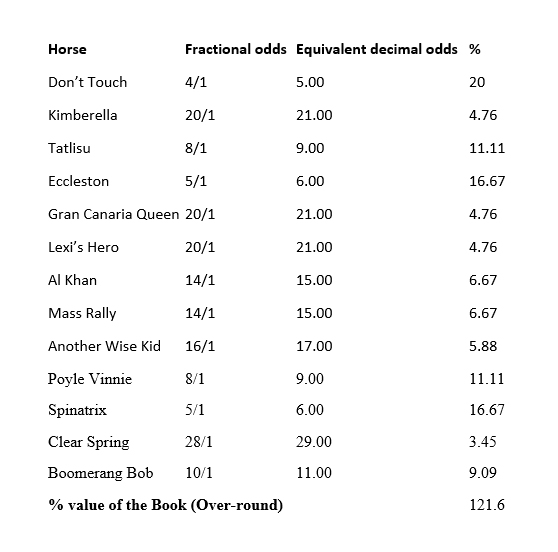

For a more real world example of an over-round, here is a sample race card taken from the Racing Post:

In the above example, the book totals 121.6%, meaning a 21.6% profit margin for the bookmaker.

However, it is not always that simple. The over-round in a betting market tends to vary depending on a number of factors:

Betting Exchanges

Exchanges are unlike bookmakers as their profits do not come from losing punters, but from a commission charge on transactions between players. This means there is no over-round applied by the exchanges themselves and this often means better prices can be found within their markets.

Further to this, if a bookmaker notices that a customer is essentially beating their Over-round by still finding good value bets, their business model means they will generally limit that customer’s bets with them, or even refuse their business completely. This is not the case when using a betting exchange.

Yes, you. We’re always looking for new authors. If you’ve got great articles/news that will be of interest to our readers and help to move our betting exchange forward, we would love to hear about them. Our aim is to bring readers a fresh perspective on all things betting. We want your article to be at its best. Once accepted, you’ll get extensive feedback from our team.